What is cryptocurrency?

A type of currency which uses digital files as money. Usually, the files are created using the same ways as cryptography (the science of hiding information). Cryptocurrencies use ‘decentralized control’ which means that they aren’t controlled by one person or government.

How does cryptocurrency work?

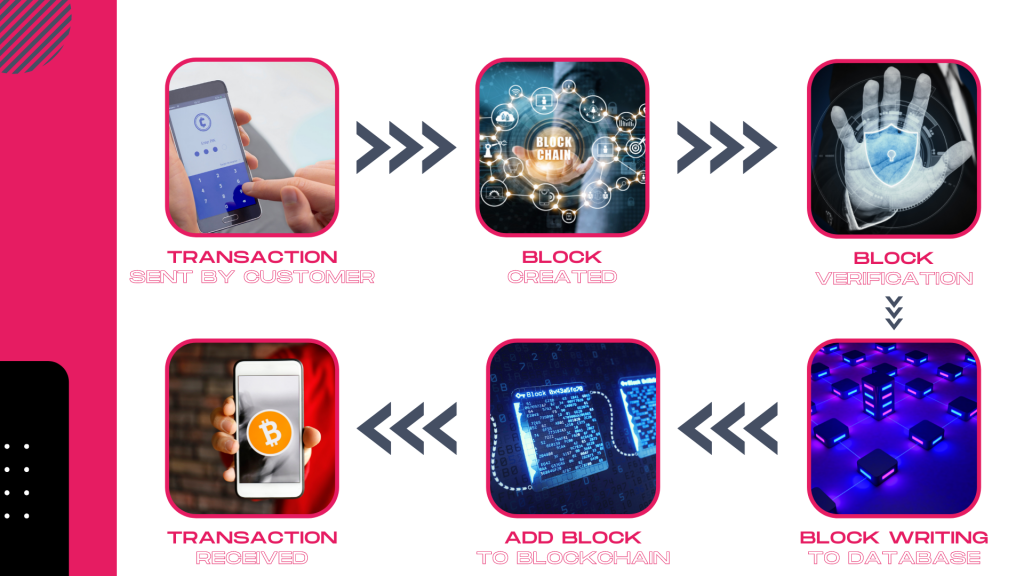

Each Bitcoin is basically a computer file, which is stored in a ‘digital wallet’ app on a smartphone or computer. People can send Bitcoins to your digital wallet, and you can send Bitcoins to other people. Every single transaction is recorded in a public list called the blockchain. This makes it possible to trace the history of Bitcoin, to stop people from spending coins they do not own, making copies, or undo-ing transactions.

Are there different kinds of cryptocurrency?

As of 2021, there are over 6,000 different cryptocurrencies. To name a few:

Bitcoin

Bitcoin Cash

Solona

Lightcoin

Etherium

Dogecoin

Tether

Cardona

Who donates cryptocurrency? Is there a specific demographic?

According to a survey conducted by Gemini Exchange, out of the 21.2 million people who own cryptocurrency (14% of the adult population):

- 74% are male

- 71% are white

- 77% are under the age of 45 (Average Age: 38)

- 51% live in suburbs

- 26% live in small towns

- Average Income: $111,000 USD

Why should non-profit organizations care about cryptocurrency?

- Accepting appreciated assets like crypto may fuel fundraising growth.

- When looking at growth over a five-year period, non-profits that strictly accept cash donations only grow by 11%. However, organizations accepting appreciated securities grow by 66%.

- When looking at growth over a five-year period, non-profits that strictly accept cash donations only grow by 11%. However, organizations accepting appreciated securities grow by 66%.

- Crypto gifts can help you get bigger gifts from the same donors.

- This means it costs the same donors less to make a gift of cryptocurrency than it would to sell their crypto and give cash. Gifts of appreciated assets like stock and crypto tend to be larger than the average cash donation (even from the same donors) because donors pass on the tax savings.

- Accepting crypto can open up a new pool of donors

- Crypto is a new source of wealth for many crypto-owners. With rapid appreciation, there is a new pool of people who hold a lot of wealth in crypto – but not as much in cash. If Bitcoin reaches a value of $200,000, half of the world’s billionaires would be crypto billionaires. If non-profits can provide an easy way to give crypto, they can tap into this growing segment of wealthy donors.

Source: https://resources.freewill.com/

What is the benefit to the donor to give through crypto rather than cash or appreciated securities? Why do people donate with crypto?

Donating crypto is one of the best ways to reduce your tax burdens. By donating cryptocurrency to non-profit organizations, your donors receive a tax deduction for the value of the crypto, and avoid the capital gains tax – which they would have paid otherwise. In summary, donating cryptocurrency translates into a larger donation amount and a higher deduction as well!

Should our non-profit organization accept virtual currency?

Yes. Although there are some, there is very little risk involved in accepting cryptocurrency. Donors of virtual currency typically fall within a younger age group, opening your non-profit organization up to a new demographic of supporters.

What are the risks involved in accepting cryptocurrency?

The valuation of cryptocurrency continues to remain volatile, so the short-term fluctuations should be considered as part of your overall portfolio risk. There are also risks related to where cryptocurrency is stored; digital wallets are only as secure as the computer they are stored on.

Does the Tuesday App offer our non-profit any protections against these risks?

- Tuesday offers a 100% Price Protection Guarantee — meaning the donation amount is locked in to the market rate, for 5 minutes at the time of the transaction.

- Tuesday securely converts cryptocurrency dollar amounts within minutes of receiving the transaction, so you do not have to worry about the risk of storage.

After receiving a donation, should we immediately liquidate the cryptocurrency assets, or hold onto them?

It is completely up to the non-profit organization to make this decision; however, we recommend liquidating crypto assets for local currency after receiving donations.

- Market Volatility

- No organization wants to see their received donation value cut in half due to market volatility. For many, the potential upside of holding onto cryptocurrency isn’t worth the potential risk.

- No organization wants to see their received donation value cut in half due to market volatility. For many, the potential upside of holding onto cryptocurrency isn’t worth the potential risk.

- Changing Regulations

- Domestic & International regulators grapple with how to regulate virtual currency. Even major players like Coinbase and Ripple have been subject to or threatened by regulatory action. Charities are often cautious when holding virtual currencies, concerned that the regulatory environment could shift in a way that devalues or freezes their holdings.

How do we treat virtual currency for accounting purposes?

Since 2014, the IRS has been clear that virtual currency should be treated as property. A taxpayer donating virtual currency they have held for more than a year may deduct the fair market value of the currency at the time of its donation, similar to other forms of property, such as publicly-traded stocks. This provides a tax benefit to your donors who invested in virtual currency in its infancy – they can support their favorite charities without being taxed on the cryptocurrency gains they’ve enjoyed.

Making a Crypto Donation

Support a cause that matters to you by selecting a charity that accepts donations in crypto.

1. Find a Charity

Either search the charity by name in the “Browse Nonprofit section”, or filter by the cause close to your heart using the dropdown option. Is your favorite charity not listed? Contact us to nominate a worthy organization. We have made it possible for several nonprofits to accept crypto because they were nominated by donors interested in supporting their cause.

2. Make Your Crypto Donation

First, select Bitcoin, Ethereum or another cryptocurrency you want to donate from the dropdown, and enter your donation amount in the crypto of your choice or USD. Next, fill out some KYC information about you including your email address where you would like to receive a tax receipt. Third, a one time dynamic wallet address will be generated for your donation and the charity’s wallet.

3. Get Your Tax Receipt

Donors can choose to receive a tax receipt via email. This will arrive as soon as your donation has received the block chain confirmation is secured, so keep a lookout for it. If you can’t see it, double check your spam or junk mail, and Contact the Tuesday App if you require it to be resent.

In addition to your emailed donation reciept you will also have a record of all the donation made under “your Donation” tab in your application. Be sure to file away your tax receipt in a safe location that is accessible when filing your tax return and use it for proof of your donation.

Donating Cryptocurrency is More Tax-Efficient than Using your Credit Card

US crypto donors pay no capital gains taxes on gifts to 501(c)3 organizations that would otherwise trigger taxable events. From a tax perspective, this is very similar to donating appreciated stocks to a charitable organization.

Compare this to the other option, of selling bitcoin and donating the after-tax assets, which would be subject to a long-term federal capital gains tax rate (and even more at a state level, depending on where you live). To put it in purely numerical terms, this avoidable tax would shrink a gift valued significantly.

The UK has also released guidelines on reducing or eliminating capital gains taxes on cryptocurrency and many more countries are providing similar guidance around donations of cryptocurrency to charity.

Note:

- Tuesday does not facilitate Anonymous Donations.

- As always, check with your accountant, financial advisor, or tax attorney before making any major decision, as everyone’s individual tax situation is unique.